MIDAS ASSET products

Real Estate FundMIDAS' solution

Real Estate Fund

Our Real Estate Funds’ core strategy is to invest at income producing properties in key domestic and international markets and structuring long-term and stable real property based portfolio.

Since the establishment of Real Estate Investment Division in 2006, we have managed assets around USD 800 million, and amid the global financial recession and mass vacancy crisis in central business districts, our team have taken rigorous approach to develop from forward purchase development projects to stable and sustainable investment asset achieving the performance and building the platform of real estate fund management services.

Our values are to provide sustainable cash distributions to investors and prudently managing distributions over time by mitigating all anticipated and unpredictable risks, pioneer in seeking class A opportunities for our investors by local level research and implementation of hands-on management strategy.

Since the establishment of Real Estate Investment Division in 2006, we have managed assets around USD 800 million, and amid the global financial recession and mass vacancy crisis in central business districts, our team have taken rigorous approach to develop from forward purchase development projects to stable and sustainable investment asset achieving the performance and building the platform of real estate fund management services.

Our values are to provide sustainable cash distributions to investors and prudently managing distributions over time by mitigating all anticipated and unpredictable risks, pioneer in seeking class A opportunities for our investors by local level research and implementation of hands-on management strategy.

Investment Target and Strategy

Target

Deliver superior returns and dividends above the market yieldto investors within the anticipated investment risks

Investment Philosophy

Based on the synergy generated by investment experts through rigorous risk management and moral compliance, we concentrate on building the competence on consistent advancement of asset management.

- Investment

Approach

- 투자지 맞춤형

- Deliver compelling and investor-specific investment solution in transparent and open market

- 투자 PROCESS

- Proven top down and elaborate research driven investment process

- 역할수행

- Exclusive and active management to secure growing cash flow and sustainable returns

- RISK MANAGEMENT

- Ad-hoc and periodic reporting and communication system with investors

- 매각전략 실행

- Specific implementation of profit maximization disposal strategy

Investment Strategy

Our investment fundamentals are focused on

with consideration of Fund and Real Estate cycle

with consideration of Fund and Real Estate cycle

- Investments in value-oriented assets

- Active purchase on real property asset that

meets to client-specific investment objectives

- Active Management

- Active management to maximize

long term net income and market value

- Capital Management

- Maximizing the investment effect through

capital management strategy within the Fund period

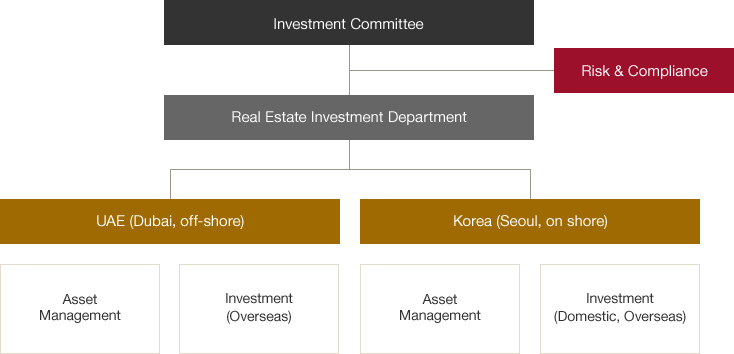

Organization

Our team is made up of domestic and overseas organization to directly manage long term real estate investment and portfolio management. Starting from 2006, we have been the groundbreaker in overseas real estate investment while the overseas professionals have been proactively involved from off-plan developments to fund management with local-on-the-ground presence.

We collaborate with top domestic and international real estate companies and organizations and developed long term relationship for strong deal-sourcing, top down investment research, due diligence and securing finance to seek opportunities and create value added returns.

We collaborate with top domestic and international real estate companies and organizations and developed long term relationship for strong deal-sourcing, top down investment research, due diligence and securing finance to seek opportunities and create value added returns.

[투자심의 위원회]

[Risk & Compliance]

[부동산운용파트]

[UAE (두바이, off-shore)] : 자산관리, 부동산 투자(해외)

[한국 (Seoul, on-shore)] : 자산관리, 부동산 투자(국내,해외)

[Risk & Compliance]

[부동산운용파트]

[UAE (두바이, off-shore)] : 자산관리, 부동산 투자(해외)

[한국 (Seoul, on-shore)] : 자산관리, 부동산 투자(국내,해외)

Portfolio

Our portfolio consists of prime grade A office buildings at core locations in domestic and overseas market where we have been proactively provided our expertise and knowledge in direct investment, development, asset management and disposal. Especially with Midas Private Equity Real Estate Fund 3, which purchased a prime grade A asset in central business district of Seoul, Korea, has performed exceptional value return with 11% annual return and 1.56x fund equity multiples. With such asset management experience and competitive investment insight, we are committed to deliver compelling solutions and expanding investment portfolio (office, retail, hotel and logistics) and add value for our clients and partners.

Checking

The information on returns on this website is only for reference. The information may not be most up-to-date. Midas Asset Management is not legally responsible for the investment decisions based on the information provided on this website.Beneficiaries should undertake all the profit/loss of the funds caused by the result of investment. Therefore those considering investing in the funds should carefully read the prospectus before making investment decisions. Past performance is not indicative of future performance. Fluctuation in exchange rates may have a positive or negative effect on the value of foreign-currency denominated securities and financial instruments. It may result in financial loss of its beneficiaries.

This website is made in the Korean language, and if there shall arise any conflict between the Korean version and any translation thereof, including this English translation, the Korean version shall prevail.