MIDAS ASSET products

Private Equity FundMIDAS' solution

Private Equity Fund

Why PEF?

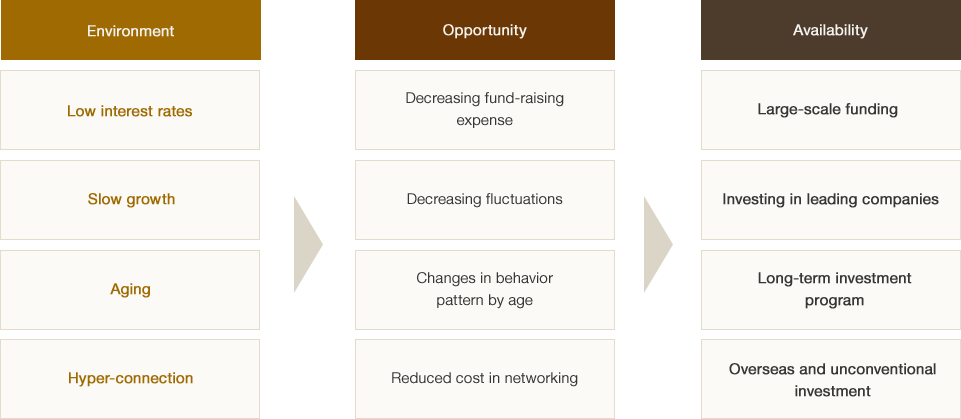

- PEF is a flexible investment vehicle that can meet a variety of investor needs from an aging and hyper-connection.

- PEF invests in unlisted equity, infrastructures and real funds that the traditional funds could not.

[Environment] : Low interest rates, Slow growth, Aging, Hyper-connection

[Opportunity] : Decreasing fund-raising expense, Decreasing fluctuations, Changes in behavior pattern by age, Reduced cost in networking

[Availability] : Large-scale funding, Investing in leading companies, Long-term investment program, Overseas and unconventional investment

[Opportunity] : Decreasing fund-raising expense, Decreasing fluctuations, Changes in behavior pattern by age, Reduced cost in networking

[Availability] : Large-scale funding, Investing in leading companies, Long-term investment program, Overseas and unconventional investment

* Source : Midasasset Private Equity

Process

- We use a top-down investment approach and prefer to invest in majority equity.

- We cooperate with legal and accounting firms to manage the risks.

- Deal sourcing

-

- Top-down analysis

- Co-work with the securities

- Industry expert advisory

- Company/project listing

- Profitability/risk analysis

- Identifying shareholder demands

- Due diligence

- Defining deal structures

- Funding

-

- Teaser deployment

- The primary candidate selection

- IM sent

- The secondary candidate selection

- LOC issue, investor confirm

- Capital call, investment execution

- Value up / Exit

-

- Improving governance

- Profit distribution

- Repayment

- Listing

- Exit by sale

* Source : Midasasset Private Equity

Checking

The information on returns on this website is only for reference. The information may not be most up-to-date. Midas Asset Management is not legally responsible for the investment decisions based on the information provided on this website.Beneficiaries should undertake all the profit/loss of the funds caused by the result of investment. Therefore those considering investing in the funds should carefully read the prospectus before making investment decisions. Past performance is not indicative of future performance. Fluctuation in exchange rates may have a positive or negative effect on the value of foreign-currency denominated securities and financial instruments. It may result in financial loss of its beneficiaries.

This website is made in the Korean language, and if there shall arise any conflict between the Korean version and any translation thereof, including this English translation, the Korean version shall prevail.