MIDAS ASSET philosophy

Fixed-income Investment ProcessMIDAS ASSET

Fixed-income Investment Process

Fixed Income Management Process

Through understanding of the customer’s needs by checking their investment objectives, expected returns, risk tolerance and operational guideline checks, we determine the basic management policies including target duration, investment bond ratings, and etc. Under basic management strategy we will construct our portfolio by adding undervalued assets which can henceforth give high returns. We will re-adjust the direction of investment strategy and portfolio through periodic assessment of benchmark performance.

![[Step. 1 Operation Strategy] : Check external guidelines, Market environment analysis and forecast (Estimate trend phase), Decide management strategy (Target duration, Credit level) | [Step. 2 Portfolio construction] : Search for high return-generating assets, Excavate and include relatively undervalued assets, Dealing Position Open (within guideline) | [Step. 3 Performance Analysis] : Evaluate adequacy of return, duration, and asset composition, Analysis of profit contributions from investment sector and maturity, Check investment goals and rebalance portfolio according to needs](https://midasasset.com/wp-content/themes/midasasset_new_eng/images/img_process3.png)

[Step. 1 Operation Strategy] : Check external guidelines, Market environment analysis and forecast (Estimate trend phase), Decide management strategy (Target duration, Credit level)

[Step. 2 Portfolio construction] : Search for high return-generating assets, Excavate and include relatively undervalued assets, Dealing Position Open (within guideline)

[Step. 3 Performance Analysis] : Evaluate adequacy of return, duration, and asset composition, Analysis of profit contributions from investment sector and maturity, Check investment goals and rebalance portfolio according to needs

[Step. 2 Portfolio construction] : Search for high return-generating assets, Excavate and include relatively undervalued assets, Dealing Position Open (within guideline)

[Step. 3 Performance Analysis] : Evaluate adequacy of return, duration, and asset composition, Analysis of profit contributions from investment sector and maturity, Check investment goals and rebalance portfolio according to needs

Fixed Income Research Process

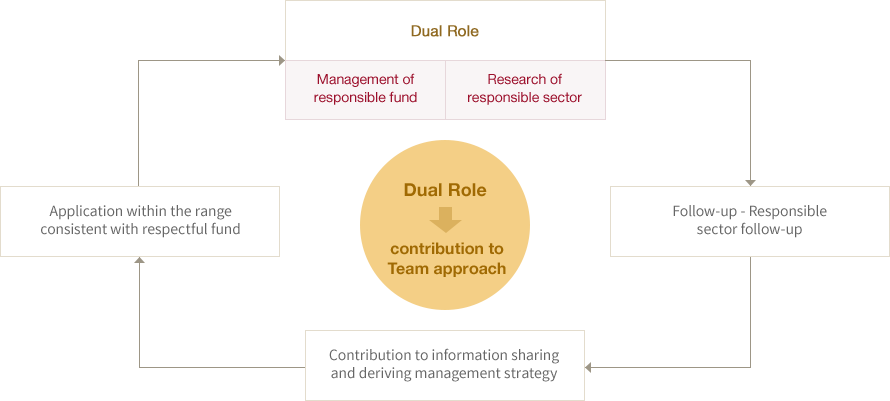

Fixed Income research task consists of analysis of basic conditions of economy (fundamental), interest rate prospects, and money market movements. Internal research within fixed income department and external research which are provided by brokerage houses, bond pricing agencies, credit rating agencies and etc. are comprehensively utilized. There is no separate research team for the fixed income department, hence each fund manager is under a dual role system in which they are in charge of fund management and sector research. The fund managers share their responsible sector information in stand meetings, and regular strategy meetings to assist in actual operation.

Fixed Income Research System

![[Internal Research] | [Fixed Income Division] : FUNDAMENTAL, Money Market, Interest Rate Outlook, Credit Trend | [Research Sector] : Fund Managers responsible for their own sector (fundamentals, money market, interest rate outlook and credit) => Each manager is responsible for expressing their opinions about their respective sector through collecting data and information management. | [External research source] : Periodically secure sell-side research data (Selection of five external resource sources for reference in weekly meetings), network with other sources | [External Company Rating System] : Utilization of credit reports from three major credit rating agencies, Utilization of Korea Investors Service (KIS) Database and Bondweb, Utilization of company valuation tools provided by KIS-NET](https://midasasset.com/wp-content/themes/midasasset_new_eng/images/img_process4.png)

[Internal Research]

[Fixed Income Division] : FUNDAMENTAL, Money Market, Interest Rate Outlook, Credit Trend

[Research Sector] : Fund Managers responsible for their own sector (fundamentals, money market, interest rate outlook and credit) => Each manager is responsible for expressing their opinions about their respective sector through collecting data and information management.

[External research source] : Periodically secure sell-side research data (Selection of five external resource sources for reference in weekly meetings), network with other sources

[External Company Rating System] : Utilization of credit reports from three major credit rating agencies, Utilization of Korea Investors Service (KIS) Database and Bondweb, Utilization of company valuation tools provided by KIS-NET

[Fixed Income Division] : FUNDAMENTAL, Money Market, Interest Rate Outlook, Credit Trend

[Research Sector] : Fund Managers responsible for their own sector (fundamentals, money market, interest rate outlook and credit) => Each manager is responsible for expressing their opinions about their respective sector through collecting data and information management.

[External research source] : Periodically secure sell-side research data (Selection of five external resource sources for reference in weekly meetings), network with other sources

[External Company Rating System] : Utilization of credit reports from three major credit rating agencies, Utilization of Korea Investors Service (KIS) Database and Bondweb, Utilization of company valuation tools provided by KIS-NET

- Split management of each fund manager’s fund within the concept of team management

- It is better to have the individual manager responsible for the outcome of the fund rather than holding the team responsible.

* But, fund managers are actively involved in strategic decision making process of team in order to prevent cases of extreme dogmatism.

- Unique team management format of the MIDAS fixed income team

- Manager’s dual role: standing meetings to share information if problems exist within their respective sector

* Fund managers request and share information about sectors that other managers cover

- Ideal implementation of team approach system

[Dual Role] : Management of responsible fund, Research of responsible sector => Responsible sector follow-up => Contribution to information sharing and deriving management strategy => Application within the range consistent with respectful fund

Checking

The information on returns on this website is only for reference. The information may not be most up-to-date. Midas Asset Management is not legally responsible for the investment decisions based on the information provided on this website.Beneficiaries should undertake all the profit/loss of the funds caused by the result of investment. Therefore those considering investing in the funds should carefully read the prospectus before making investment decisions. Past performance is not indicative of future performance. Fluctuation in exchange rates may have a positive or negative effect on the value of foreign-currency denominated securities and financial instruments. It may result in financial loss of its beneficiaries.

This website is made in the Korean language, and if there shall arise any conflict between the Korean version and any translation thereof, including this English translation, the Korean version shall prevail.